The Design Direction

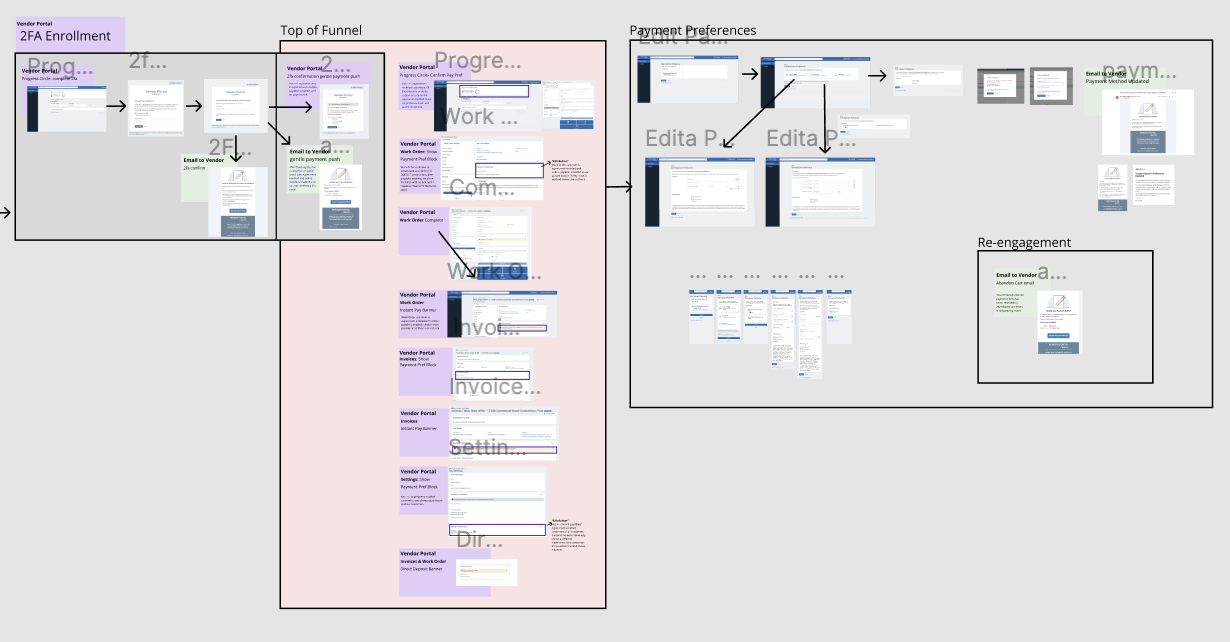

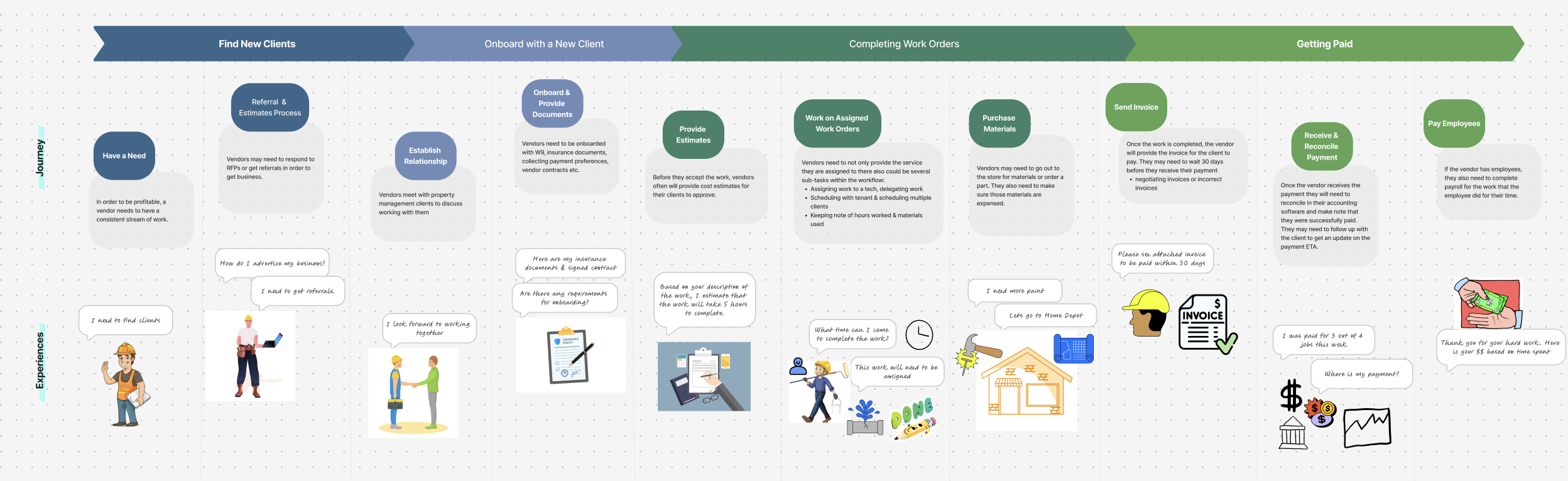

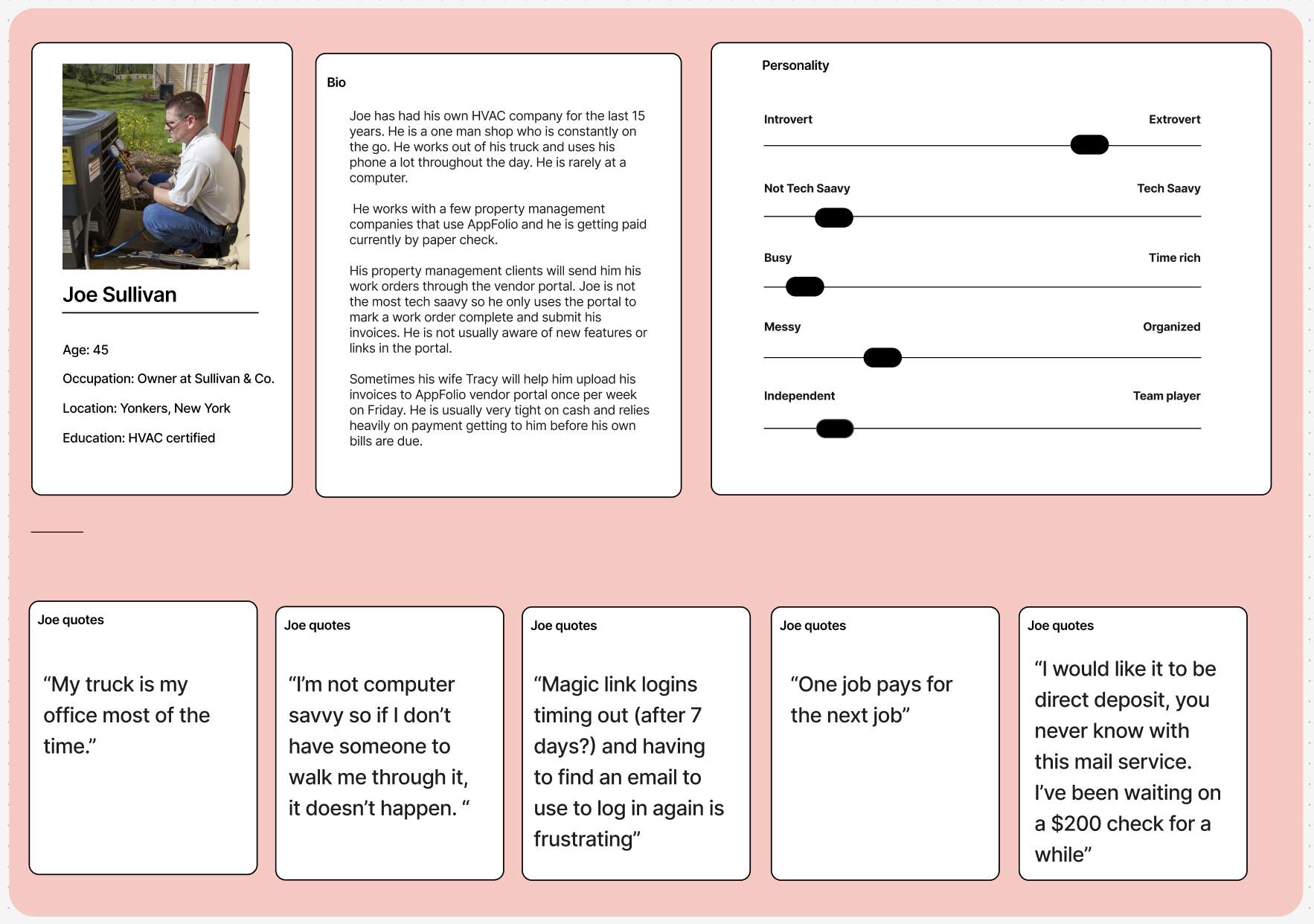

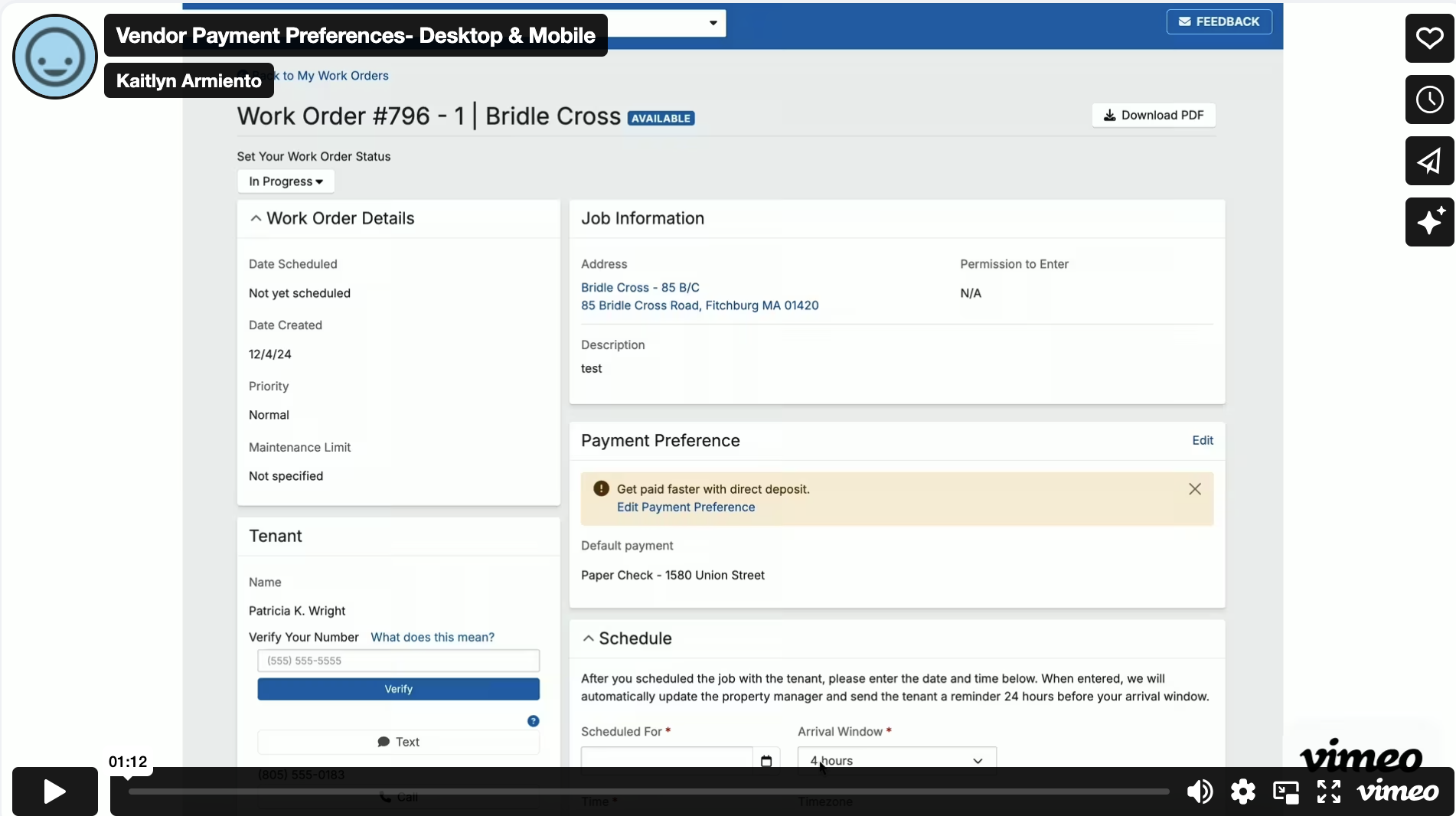

We focused on creating a vendor-first experience that made payment selection clear, secure, and easy to complete. The initial launch prioritized letting vendors choose how they wanted to be paid, while parallel work strengthened security through two-factor authentication.

To address vendor demand for faster access to funds, we introduced Instant Pay through a third-party integration. This gave vendors flexibility while preserving transparency around fees and timing.

Behind the scenes, shifting technical constraints required frequent iteration. Payment logic changed, backend limitations surfaced, and flows were reworked more than once. I continuously adapted the designs to keep the experience cohesive, even as the system underneath evolved.

.jpg)